Essential Steps to Use and acquire Bid Bonds Efficiently

Browsing the intricacies of proposal bonds can considerably affect your success in safeguarding agreements. To approach this properly, it's important to recognize the fundamental steps entailed, from collecting necessary documentation to picking the best surety company. The journey begins with organizing your financial declarations and a comprehensive portfolio of past jobs, which can demonstrate your reliability to prospective sureties. The real difficulty lies in the meticulous option of a reputable supplier and the strategic application of the proposal bond to improve your competitive edge. What follows is a more detailed consider these essential phases.

Understanding Bid Bonds

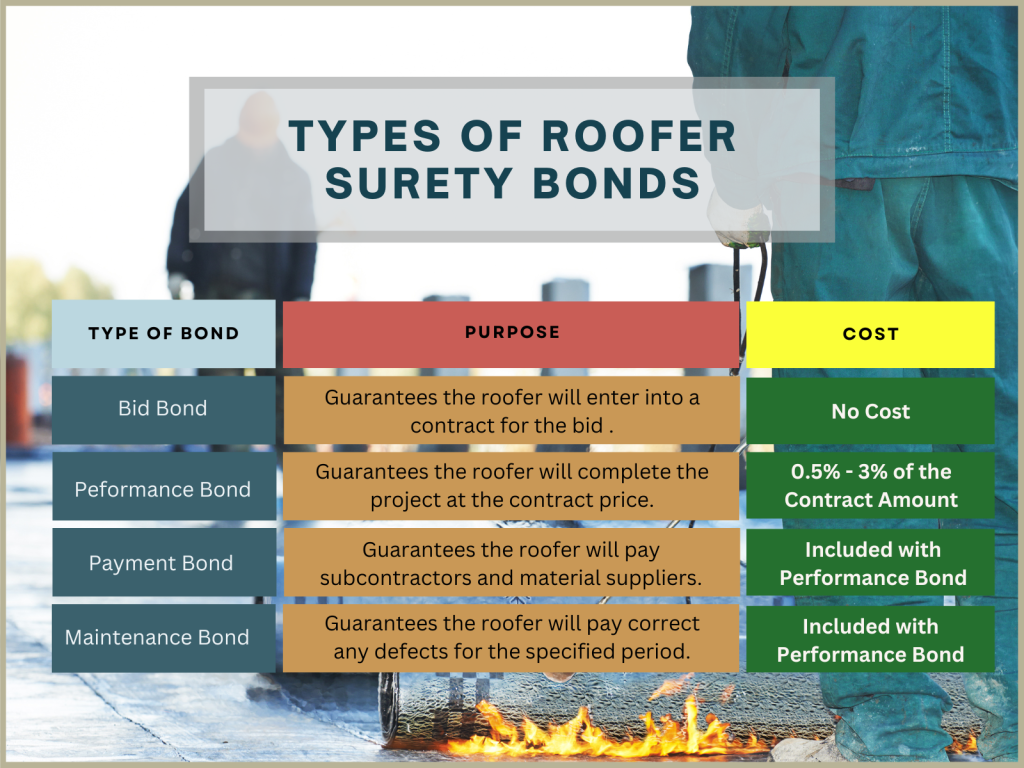

Proposal bonds are a vital component in the building and construction and contracting sector, acting as an economic assurance that a prospective buyer means to become part of the contract at the quote rate if awarded. Bid Bonds. These bonds minimize the danger for task owners, ensuring that the selected professional will not just honor the proposal however additionally safe performance and settlement bonds as required

Essentially, a proposal bond serves as a guard, securing the project owner versus the economic implications of a specialist falling short or taking out a bid to commence the job after option. Generally provided by a guaranty firm, the bond warranties compensation to the proprietor, frequently 5-20% of the quote amount, ought to the professional default.

In this context, quote bonds cultivate an extra trustworthy and competitive bidding process setting. They compel service providers to existing realistic and serious quotes, recognizing that an economic fine towers above any kind of breach of commitment. Additionally, these bonds guarantee that just solvent and credible contractors take part, as the rigorous credentials procedure by guaranty companies screens out much less dependable bidders. As a result, proposal bonds play an essential role in keeping the stability and smooth procedure of the construction bidding procedure.

Planning For the Application

When planning for the application of a proposal bond, meticulous company and thorough documentation are paramount. An extensive testimonial of the task specifications and bid needs is necessary to make certain compliance with all specifications. Start by putting together all needed financial declarations, including annual report, income statements, and cash money circulation declarations, to show your firm's financial wellness. These papers need to be current and prepared by a certified accountant to boost credibility.

Following, put together a listing of past tasks, particularly those comparable in extent and dimension, highlighting successful completions and any kind of qualifications or awards received. This profile functions as evidence of your firm's capability and integrity. Furthermore, prepare a comprehensive company strategy that outlines your functional method, risk administration methods, and any backup prepares in position. This plan provides an all natural view of your company's method to project implementation.

Make certain that your organization licenses and enrollments are updated and conveniently available. Having these papers arranged not just speeds up the application process yet additionally predicts an expert picture, instilling confidence in possible guaranty providers and job owners - Bid Bonds. By carefully preparing these components, you position your firm favorably for successful bid bond applications

Discovering a Guaranty Provider

A surety firm familiar with your field will certainly much better understand the one-of-a-kind risks and needs connected with your tasks. It is likewise suggested to review their economic ratings from agencies like A.M. Finest or Requirement & Poor's, ensuring they have the financial stamina to back their bonds.

Engage with several suppliers to contrast rates, terms, and solutions. An affordable evaluation will certainly help you secure the most effective terms for your proposal bond. Ultimately, a detailed vetting process will certainly make certain a trustworthy collaboration, promoting self-confidence in your bids and future projects.

Submitting the Application

Sending the application for a bid bond is a vital step that needs careful focus to detail. This procedure starts by collecting all pertinent documentation, including monetary declarations, task specs, and a detailed service background. Ensuring the precision and efficiency of these documents is critical, as any type of inconsistencies can result in hold-ups or denials.

When submitting the application, it is suggested to confirm all access for precision. This includes confirming numbers, ensuring appropriate signatures, and validating that all necessary attachments are consisted of. Any mistakes or noninclusions can weaken your application, triggering unnecessary problems.

Leveraging Your Bid Bond

Leveraging your bid bond effectively can considerably boost your competitive edge in safeguarding agreements. A proposal bond not just demonstrates your economic stability but additionally reassures the task proprietor of your dedication to fulfilling the agreement terms. By showcasing your bid bond, you can highlight your firm's reliability and trustworthiness, making your bid attract attention amongst many competitors.

To leverage your proposal bond to its maximum possibility, guarantee it is offered as component of a detailed quote package. Highlight the toughness of your surety provider, as this reflects your firm's economic health and wellness and functional capacity. In addition, emphasizing your performance history of successfully completed projects can further infuse self-confidence in the project owner.

Moreover, keeping close interaction with your surety service Discover More provider can facilitate much better terms in future bonds, hence reinforcing your affordable placing. A positive strategy to managing and restoring your bid bonds can also avoid lapses and make sure continual insurance coverage, which is important for ongoing project purchase efforts.

Conclusion

Efficiently getting and making use of quote bonds demands extensive preparation and strategic implementation. By comprehensively organizing key documentation, picking official statement a credible surety service provider, and submitting a complete application, firms can secure the essential bid bonds to improve their competitiveness. Leveraging these bonds in propositions underscores the company's integrity and the stamina of the surety, inevitably raising the probability of securing contracts. Constant interaction with the surety company ensures future chances for successful task quotes.

Recognizing a respectable surety company is an important action in safeguarding a proposal bond. A quote bond not just shows your economic security yet additionally guarantees the project owner of your commitment to fulfilling the agreement terms. Bid Bonds. By showcasing your proposal bond, you can highlight your firm's reliability and reputation, making your proposal stand out amongst countless rivals

To take advantage of your bid bond to its max potential, guarantee it is offered as component of a comprehensive quote bundle. By comprehensively arranging vital paperwork, picking a trusted surety provider, and sending a total application, firms can safeguard the required quote bonds to improve their competition.